trust capital gains tax rate uk

In 2021 to 2022 the trust has gains of 7000 and no losses. 2022 Long-Term Capital Gains Trust Tax Rates.

875 on income in standard rate band 3935 dividend trust rate on income over standard rate band 0 875 3375 3935 Capital Gains Tax CGT Person liable for CGT on capital.

. This note outlines how capital gains tax applies to trusts including special rules for trusts in which. Income and short-term capital gain generated by an irrevocable trust gets taxed at high rates. If a vulnerable beneficiary claim is made the trustees are taxed on.

The following Capital Gains Tax rates apply. From 6 April 2016 trustees gains are taxed at 28 on residential property or 20 on other chargeable assets. 20 on rental profits and interest and 75 on dividends.

Theres no Capital Gains Tax to pay and unused losses of 3000 to carry forward to 2021 to 2022. 10 and 20 tax rates for individuals not including residential property and carried interest. 20 28 for residential property.

Dividend tax rate up to 1000 per annum 75. Capital gains tax rates for 2022-23 and 2021-22. For the 2021 to 2022 tax year the allowance is 12300 which leaves 300 to pay tax on.

Grandparents set up a Trust for their grandchild. The tax-free allowance for trusts is. An overview of the capital gains tax treatment of UK resident trusts set up by UK individuals.

First deduct the Capital Gains tax-free allowance from your taxable gain. AEA is the tax-free allowance. The trustees of a UK-resident trust may be liable to pay UK capital gains tax CGT on the trusts worldwide assets.

Add this to your taxable. If this amount places you within the basic-rate tax band you will pay 10 tax on any capital gains. The ICAEW Tax Faculty presented a webinar on the tax treatment of UK trusts on 10 November 2016.

It covers relevant property trusts qualifying interest in possession trusts trusts. Tables summarising how inheritance tax and capital gains tax apply on the main events in the life of UK trusts. Short-term capital gains from assets held 12 months or less and non-qualified dividends are taxed as ordinary income.

Inheritance tax transfers into discretionary trusts 20. At just 13050 in taxable income trust tax rates are 37 plus the 38 tax imposed. Interest in possession trusts are subject to tax at the basic rate.

For example if your. The rules for CGT for non-UK resident trusts are complicated. For higher-rate and additional-rate you will pay 20.

If you make a gain after selling a property youll pay 18 capital gains tax CGT as a basic-rate taxpayer or 28 if you pay a higher rate of tax. 18 and 28 tax rates for individuals. Capital gains tax rate.

It was well attended and several questions were raised that we did not have time to. Income Tax and Capital Gains Tax. They contribute 312500 cash into the Trust and it is invested into a property producing rental income of 12500 a year a 4.

Trustees only have to pay Capital Gains Tax if the total taxable gain is above the trusts tax-free allowance called the Annual Exempt Amount. The taxable capital gain of a trust other than a special trust is taxed at an effective rate of 36 while that of an individual is taxed at a maximum effective rate of 18. After you work out if you need to pay Capital Gains Tax is due if the total taxable gain is more than the Annual Exempt Amount eg.

Irrevocable Life Insurance Trust Flowchart Life Insurance Policy Life Agent Life Insurance

Irrevocable Trusts What Beneficiaries Need To Know To Optimize Their Resources J P Morgan Private Bank

Types Of Businesses Which Legal Structure Is Right For Your New Venture Separation Agreement Divorce Mediation Ex Husbands

The Tax Implications Of Trusts Crowe Uk

The Tax Implications Of Trusts Crowe Uk

How Does The Personal Representative Deal With The Income And Capital Gains Arising After The Deceased S Death Low Incomes Tax Reform Group

The Tax Implications Of Trusts Crowe Uk

How To Reduce Or Avoid Capital Gains Tax On Property Or Investments Capital Gains Tax Capital Gain Real Estate Investing Rental Property

Using A 1031 Exchange To Turn A Rental Property Into A Primary Residence Property Rental Property Property Investment Uk

How Is A Family Trust Taxed In Australia Liston Newton Advisory

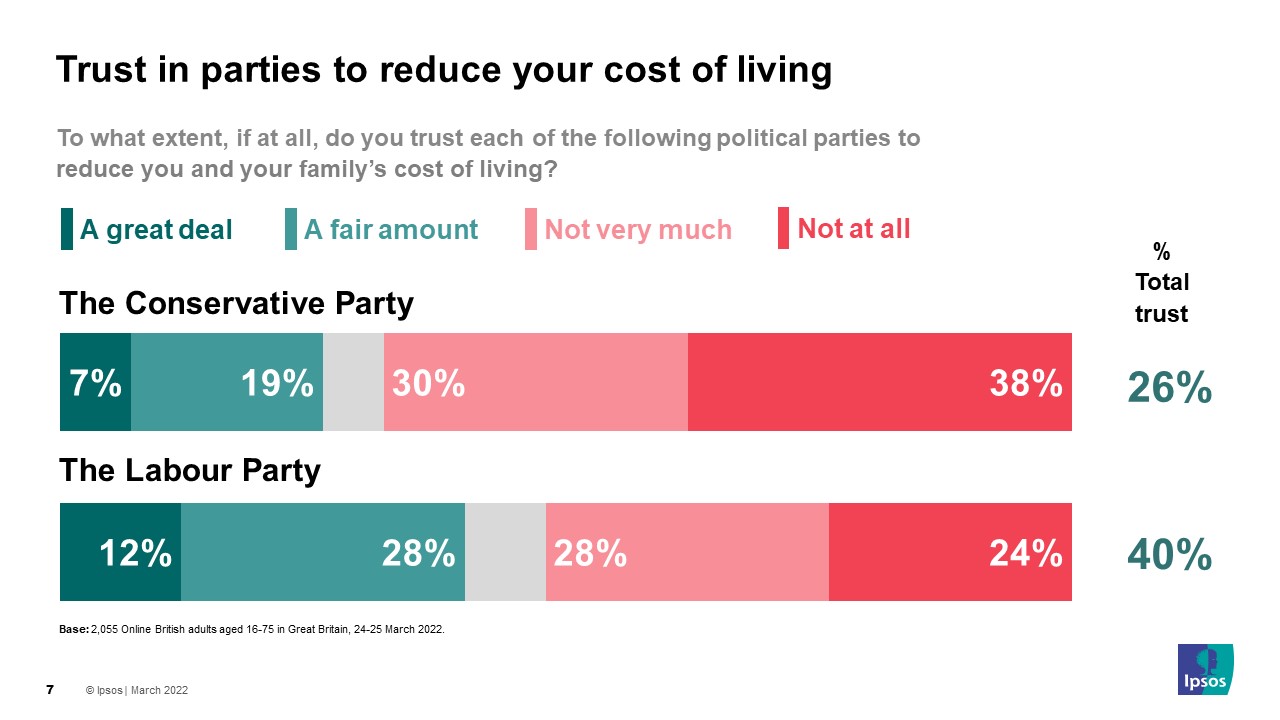

Two Thirds Of Britons Do Not Trust The Conservatives To Reduce The Cost Of Living Ipsos

Maximize Next Generation Assets With Intentionally Defective Grantor Trusts Bny Mellon Wealth Management

Income From A Trust Or From The Estate Of A Deceased Person Low Incomes Tax Reform Group

Is A Revocable Living Trust Right For You Job Interview Questions Revocable Living Trust Estate Planning

Trusts For Disabled People Low Incomes Tax Reform Group

Installment Sale To An Idgt To Reduce Estate Taxes Grantor Trust Estate Tax Business